Tax-deductible Donations Support AAUW’s Mission

AAUW National is recognized by the IRS as a non-profit entity under 501(c)(3). That means donations not only help AAUW’s advocacy efforts for gender equity, but are tax deductible as well. Donations can be directed to several individual funds that comprise AAUW Funds. Get details on AAUW’s website. Highlights are below:

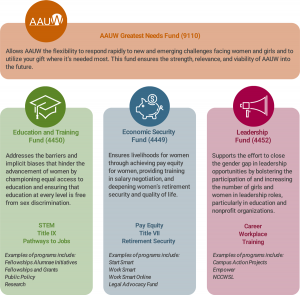

- Greatest Needs Fund (9110)– Gives AAUW the flexibility to respond to emerging challenges quickly, because donations are not restricted to specific projects.

- Education & Training Fund (4450)– Supports STEM and Title IX and is one of the world’s largest sources of funding for graduate-level grants and fellowships. Click here for a list of the latest recipients in Florida. Find current funding opportunities on the AAUW website.

- Leadership Fund (4452)– Supports programs to close the gender gap in leadership opportunities by addressing systematic biases and giving women the skills and resources they need to lead.

- Economic Security Fund (4449) – Promotes women’s livelihoods through advocacy for fair-pay, legislation, researching the pay gap, training women to negotiate for the salaries they deserve, and advising employers on fostering fair cultures.

- Governance and Sustainability Fund (4451)– Enables AAUW to function as effectively and efficiently as possible—following the latest best practices for hiring and governance and incorporating state-of-the-art technology into our member database and other systems.

- National Conference for College Women Student Leaders Scholarships (2504) – Provides access for a broader and more diverse audience to be a part of the leadership training, inspiration and networking opportunities provided during this event.

Individual donations can be made through the AAUW website. If your branch does fundraising for AAUW Funds, you’ll find a helpful overview of policies and tips in a presentation given by Diane Ludwig, a Certified Fundraising Professional. You can read the presentation slides here.